How I Build My Travel Fund So I Can See The World Using My Budget Planner!

Last Updated on 08/16/2025 by Nicky

How I Build My Travel Fund So I Can See The World Using My Budget Planner

I don’t know about you but for me traveling is essential for my mental health. I can’t tell you how much joy it gives me to stand in line at the airport.

I know I know it sounds crazy! However, it’s a signal to my heart that I’m about to embark on a journey to a new and exciting destination. And I can’t wait! There’s only one problem with traveling. It can be super expensive.

So it is vital that you create a travel fund so that you don’t go broke every time you go on a trip. That’s why today I’m going to share with you 6 of the best ways to build a travel fund so that you can see the world. Let’s go!

Oh yeah, and this post contains affiliate links to great products that will help you in your health journey. I will get a commission if you decide to buy from these links. Please let me know if you have any questions.

– What Is A Travel Fund?

All right y’all so what is a travel fund? Now I know what a travel fund is for me. A travel fund for me is a fund for freedom and adventure! But perhaps you want more of a technical definition? OK so here it goes.

A travel fund is a fund that you use to pay for your travel but I know that’s way too simple so let me break that down for you. So most people have a bank account, right?

And with this bank account, you pay for your rent your electric bill your groceries, and all of your various monthly expenses. But with a travel fund, you don’t do any of that. Travel funds should actually be a savings account that is separate from your general bank account.

This should be an account that is fairly difficult for you to access.

Meaning it should be a fund that you would not be using on a daily basis.

Why?

Because it’s very difficult to build a fund or a bank account that you use every day. So this should be an account that does not have a debit card associated with it.

Instead, it should be in a bank that’s separate from your primary bank. For instance, I pay my bills using an account at one bank and my travel fund is at a completely different bank.

This way it makes it very difficult to spend the money in my travel fund and that money is there when I need it.

Want to read this post later? Save it to one of your budget planning Pinterest boards by clicking here!

– Why Traveling Is Important For Your Mental Health (Well At Least It Is For Mine)

Why is traveling important for your mental health? Well first let me say that this is only true if you actually enjoy traveling. If you don’t then clearly traveling is not good for your mental health so I just want to get that out of the way first.

But for those of us who do enjoy traveling, why does it boost our moods? I’ve come up with 5 amazing reasons why I believe this is the case. These are just my own personal observations but I believe they’re valid:

1) Getting to be in a new environment

The anticipation of stepping into a whole new world is so exciting! I love reading about all of the different landmarks and attractions and surprises that each new location has in store for me! You never know what new adventures you might stumble into when you travel.

Whereas your home life can start to get stale and boring.

I know that traveling won’t fix your problems or truly change your mental state with one trip but it can act as a distraction from whatever is plaguing you. Plus, over time, with each new journey, your mental state can skyrocket!

2) It’s a reminder that the world is bigger than your corner of the planet

Another way traveling is beneficial is that it acts as a reminder that the world is so much bigger than what’s going on in your corner of the world. I know how easy it is to get caught up in a situation going on at work or at home.

You can become so consumed with your problems that you can’t concentrate on anything else. But going on a trip can open your eyes to a whole new world around you.

And having some distance between you and your problems can provide you with a different perspective once you get back home.

3) When you travel, you have new experiences

This kind of relates to the last point I made the new experiences that you will have when you travel are unmatched. Just think about it.

Every day is probably the same as the last. You wake up, go to work, come back home, and you get ready for the next day just to do it all over again.

But only on vacation, there’s a whole world of adventure just waiting to unfold. You get to meet new people… see new things. Instead of just looking at landmarks, say in a history book or online, you get to say wow I am seeing this in person.

It’s the coolest thing!

When I look at pictures of the Eiffel Tower I can say “Wow, I have seen that in real life!”

What an honor and a privilege to be able to say that and I’m truly grateful for all of the places I’ve been able to visit and the things that I’ve been able to do.

4) Gives you wonderful memories to reflect on

A memorable meal at that restaurant next to your hotel. Running through the airport to catch your connecting flight.

All of these different experiences that you have when you go on a trip will soon turn into fond and funny memories that you can hold onto when you’re at work and you’re grumpy or when you feel sad or lonely.

You can grab onto these travel memories and for a brief moment forget or at least be distracted from whatever issues you’re facing currently.

5) Gives you something to look forward to

And finally, traveling or the anticipation of traveling gives you something to look forward to.

There are so many places in this world I want to see and experience in real life. And just the mere thought of being able to do those things one day fills me with hope.

And it inspires me to save money and create a travel fund to make sure that these trips actually do happen.

So let’s find out some ways that we can build a travel fund because I think you’ll be pleased to know that it’s not as hard as you might think.

Want to read this post later? Save it to one of your Pinterest boards by clicking here!

– The 6 Best Ways To Build A Travel Fund

OK so hopefully by now y’all are excited to go somewhere. You’re looking forward to starting a travel time because you are ready to hit the road! so where do we start?

1) Determine the cost of your trip

The first thing you need to know is how much your trip will cost. I’m talking about the flight, the hotel room, the rental car if that’s needed, and the passport if that’s something that you don’t have.

For anything that really will cost money on this trip, I want you to start calculating it. You can use a spreadsheet or a Google doc or a Trello or Notion, or whatever it is that you want.

Want to look at this product later? Save it to one of your budget planner Pinterest boards by clicking here!

But for our example, we are going to use a budget planner…more specifically, the budget planner that I have in my shop.

Now start plugging in those numbers!

“But Nicky I don’t know how to do this…where do I start?”

OK let me walk you through it step-by-step!

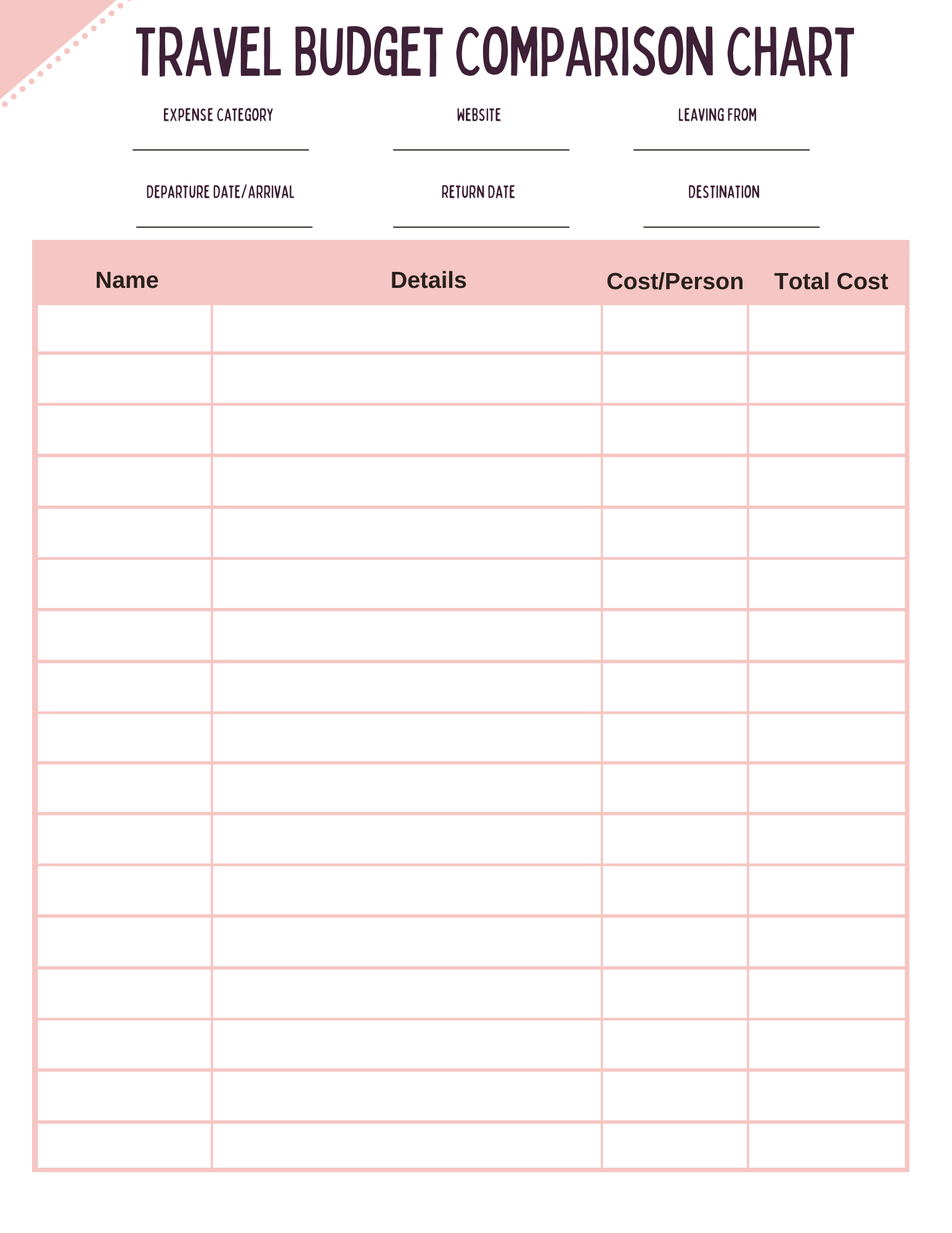

– How To Use A Travel Budget Comparison Chart

a) Open the budget planner or document on the platform of your choice.

You can choose to use the travel comparison chart in my budget planner, like the one pictured above or you can create your own chart.

The key is just to use the best platform for you!

b) Print a separate page for each of the following applicable categories

Hotel

Airline ticket

Car rental

Only you know if you need these categories. If you choose to use the budget planner travel budget comparison chart, then just write then you can print out a separate sheet for each category that you need.

For instance, if you know you need a hotel room and a car rental, then print two pages of the travel fund chart. If you only need to rent a car, then just print one page.

Then fill out the prompts at the top of the chart.

And if you prefer to create your own document, it will be easier to do the next steps if you go ahead and create a table of some sort so you can make comparisons in an organized way.

Once you figure out which categories you need and you’ve got the document (or app) or your choice created, move on to the next step.

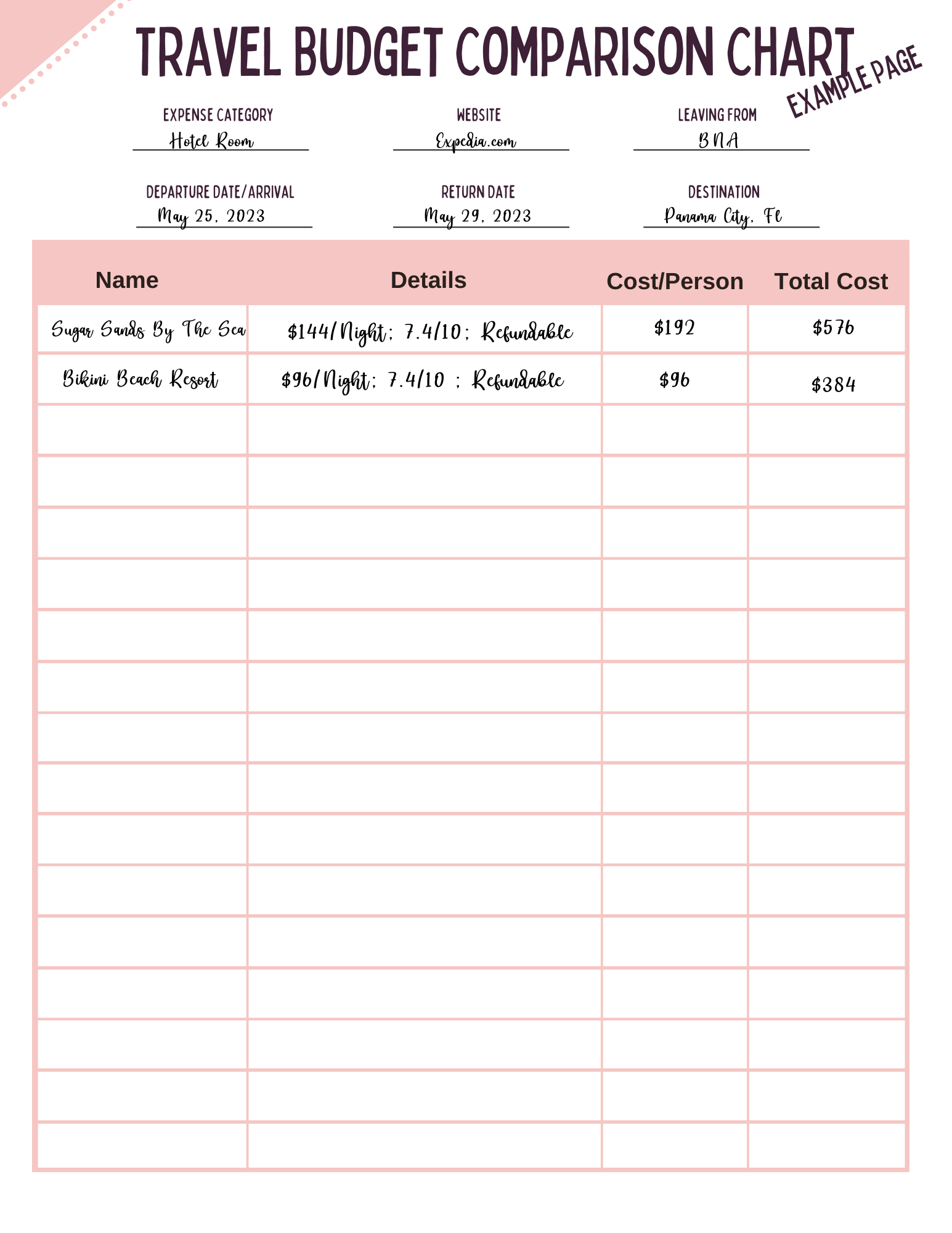

c) Start researching some of the major travel sites like Expedia & Hotels.com

Now start giving Google a good workout.

We want to compare the prices for each of these categories by different companies. Meaning, we want to see how much Expedia, Travelocity, and Orbitz (does that still exist?) charge for flights to your dream location.

Then you will check different hotels for price comparisons and so on.

Look at the chart below. These are real-world examples that I just searched for.

We can see that for the Sugar Sands hotel in Panama City, Fl, the cost is $144 a night, while the Bikini Beach Resort is only $96 a night, and they both have the same user ratings.

Want to look at this post later? Save it to one of your budget planner Pinterest boards by clicking here!

So clearly, you’re going to save a whole lot more staying at the Bikini Beach Resort as it’s only $96 per person! See how easily and quickly you can see which options are the better deal when you use a comparison chart?

That’s why I recommend using a budget planner of some sort in order to make sure you get the best travel deal possible!

You can use the code TWENTYFIVE to save 25% off of the price of the Christian Girl’s Personal Finance Planner which includes the Travel Budget Comparison Chart!

Click here to get the Christian Girl’s Personal Finance Planner!

You would just continue to go through all of the hotels that you are interested in and fill out the l

d) Once you’ve done all of your price comparisons, choose the best deal for you!

You now have your target cost and know how much money you need to add to your travel fund. Of course, you have to be aware that prices will change.

If you don’t plan on booking your trip in the very near future, at the very least you have an idea of how much you need to save. Just know that the price might increase or decrease (but let’s be honest…it’ll probably just increase) over time.

Going all in and charging your trip with Visa or Mastercard is an option (because you might get points right?) but I don’t recommend using credit cards. I’m not huge on using credit cards and creating debt unless you can pay off your balance every month.

Pro Travel Tip: You can usually save big when you buy a package.

This means it is usually cheaper to buy a hotel, flight, and car package all from one company than it is to buy a hotel room from Hotels.com and then a flight from Southwest, and a car from Hertz. This isn’t always the case but many times it is.

2) Next set financial goals that will help you save enough money for your dream trip.

Once you know how much money you need to save for your trip, break that amount down into smaller financial goals.

For example, if you need $5,000 to fund your vacation (big baller!), break that amount down into smaller goals like saving $100 per month or $50 per week. Of course, it’s going to take a while to save $5000 by only setting aside $50 a week. So you need to know when you plan on taking your vacation as well.

Anywho, by setting financial goals and saving small amounts consistently, you can easily build a travel fund and reach your travel goals.

3) Stop Spending So Much Money

So remember when I said it’s going to take a while to save $5000 by only putting aside $50 a week?

To speed things up (because you’re ready to go on vacation like yesterday!), you can begin by reviewing your monthly expenses and then finding ways to cut back.

I know you can’t just stop spending money but you can probably cut back somewhere even if you don’t believe you can.

By reviewing your expenses and finding ways to cut back, you will be able to add more money to your budget for your dream trip.

And you would be surprised how much you can save by just taking a little gander at how much you spend and seeing what you can eliminate from your budget.

Don’t have a budget yet? You can read my post about creating a budget here!

– Ways To Cut Back On Your Expenses To Build A Travel Fund

For example, one way to cut back on expenses is to reduce your cell phone plan. I mean do you really need unlimited data?

Yes…well, okay me too but maybe there are some other features you can get rid of. I mean Aruba (or wherever your bucket list vacation is) is on the line here, ma’am! So we’ve got to find little ways to cut back here and there, which will add up to big results over time!

Go through your bank account statements with a fine tooth comb and see where your money is hanging out.

Call your cable, internet, and phone companies to see if you can lower your monthly bills. And if they can’t, you might want to say “See ya” and find other companies to work with.

I used to pay almost $200 a month for my cable, phone, and internet. And the only one of those services I really used was the internet! I decided to kick Charter to the curb and found better and cheaper deals elsewhere.

Another big expense that you can probably cut is your car insurance premium. I recently did this and found that I could save around $300 a year by switching my insurance company.

No, it’s not a ton of money but remember… we are accumulating money and watching it bloom and grow into a beautiful travel fund!

So go and compare your insurance rates between different companies to see if you can find a lower quote. Be sure to check to see if you are getting the same coverage with the new company.

We want to compare apples to apples here, know what I mean?

You might also decide that you want to decrease your coverage to save money on car insurance.

This may or may not save you a lot in the long run though. I called my insurance company to see how much money I would save if I lowered my coverage on bodily damage protection. It was a big fat $2. Noooot the savings I was hoping for :)!

Another option that I really like and have done in the past is pausing a service. For instance, I truly only watch TV during football season.

After it ends, I will probably pause my Youtube TV service and then just unpause it later on in the year. I can save hundreds of dollars by doing that alone!

4) Look For Ways To Make Extra Cash

It’s not just about eliminating expenses. There are only so many ways you can cut expenses. So now it’s time to find ways to make more money than you do now. You can do this by getting a side hustle, increasing your hours at work, or applying for a promotion at your job.

One way to earn money is by getting a part-time job. I know you may not want to do it or even have time to do this. But if you do, working part-time while you are saving for your trip can help you earn extra money just that much faster!

There are lots of ways to find a part-time job such as applying at local restaurants, retail stores, or online. These days it seems there are help wanted signs everywhere so it shouldn’t be too hard to find one.

Look for ways to make money by selling items around your house on Facebook Marketplace or Makari. Do freelance work online on Fiverr.

5) Have A Dedicated Saving Account That You Can’t Access Easily

These next two tips are the real secrets to saving in your Travel fund! I promise these will make a huge difference!

What you MUST do is open a separate bank account for your travel fund. Wait… separate from what? Separate from your main bank account. Meaning, the bank account that your bills are automatically taken from (more on automatically later!).

I recommend Ally Bank because you actually earn interest on your money! Plus, as far as I know, there aren’t any fees (but don’t quote me on this). The beauty of this hack is that it is SEPARATE. “Ummm, yes, I know…you already said that”.

I know I did but I want to drive this point home. If your money is separated from your normal everyday financial goings-on, then that money just sits there unbothered and untouched BUT it continues to grow both with the next tip and with compound interest!

This is exactly what you want! You don’t want a debit card associated with this savings account (unless you think you can control yourself…be honest).

You want to use it for DEPOSITS only and very rarely for withdrawals. Having a separate savings account that isn’t super easy to access forces you to think for a while about whether or not what your trying to buy is really worth it.

I think if you open a savings account with Ally Bank you also have to have a checking account which means you can also get a debit card too.

Please don’t save your debit card info onto your Amazon account or wherever you like to shop online. Because what will wind up happening in many cases is that you will transfer money from your savings (i.e. your travel fund) into your checking. I don’t want that for you.

I want you on that plan for the vacation of your dreams! This tip is GOLD but the magic really happens when you also do the next tip.

6) Have Money Automatically Deposited Into The Account

We have our separate savings account that is now our travel fund. And while we might think, I’ll transfer money into that account whenever I get paid, many times, the craziness of life makes us forget all about our goals.

That’s why setting up an automatic transfer into your account is vital to really building your travel fund!

When you automate your savings, you don’t have to think about it or remember to do it each week or month. Give your poor brain a break and automate your savings! This way, you can be sure that you will save the amount you want each month.

The way I have mine set up is that I automatically transfer a certain amount each week from my main bank account into my separate savings account. I never have to think about it and I can just watch my account grow week after week.

It’s amazing! Before you know it, you can have your travel fund and be booking your flight to your dream location! I’m so excited for you!

Want to read this post later? Then save it to one of your Pinterest boards by clicking here!

– Let’s Recap On How To Build A Travel Fund

Okay, ya’ll so let’s quickly go over the steps to build a travel fund one more time okay

1) Determine the cost of your trip: Do some research to figure out a ballpark cost of your trip. You can use a budget planner comparison chart like the one below you or a spreadsheet to write down all of the comparison costs.

2) Next set financial goals that will help you save enough money for your dream trip: Now that you know how much money you need to save for your trip, set some financial goals like how much you can afford to save per money to put in your travel fund and how fast you need to save the money.

3) Start cutting your expenses to contribute to your fund: Look for ways to cut your monthly expenses and put that money directly into your travel fund every month

4) Make Mo’ Money: Look for ways to make extra money like getting a second job, starting a side hustle, or starting a small business, and funnel that money into your travel fund.

5) Have A Dedicated savings account That You Can’t Access Easily: Designate a special savings account just for your travel fund and do not touch it except for travel-related purposes!

6) Have Money Automatically Deposited Into The Account: Set up an automatic transfer from your main bank account to your separate account and once again do not touch it except for travel-related purposes!

Oh sorry, loves, I left out one very important step…once you’ve saved all of the money you need for your trip, go book it and have a wonderful time!

If How To Build A Travel Fund has helped you, please share it on Pinterest Or Facebook! Thanks!

Financial Disclaimer: Healthy As You Can (blog posts & products) is not offering any kind of financial advice. Any financial results discussed on this blog are not typical or guaranteed. Healthy As You Can is not a registered financial, investment, legal, tax advisor, or broker. This blog is for information and entertainment use only. A financial fund’s past performance does not predict or forecast its future results.