Free Christian Budget Planner Printable To Help Your Family Save Thousands Of Dollars

Last Updated on 02/08/2024 by Nicky

Free Christian Budget Planner Printable To Help Your Family Save Thousands Of Dollars

What’s up y’all! I’m really excited to share these beautiful Christian budget planner printables with you because I know how much budgeting has helped me.

I used to be in over $10,000 of debt with virtually no savings.

But praise God, through budgeting I have been able to eliminate MOST of my debt and also have a positive net worth with thousands of dollars in savings and I hope using this financial planner will do the same for you too!

I want YOU to experience that same kind of freedom and by using this mini Christian budgeting planner printable, you will be taking a major step in that direction!

So i hope you’re ready to embrace a more organized approach to managing your money because that’s what this mini beautiful (and FREE) budget planner printable is going to do for you!

Plus, I am going to show you where you can get a full sized budgeting planner printable called the Christian Girl’s Budget Planner!

And of course, I’ll show you step-by-step how to use this printables in real life because I love to teach! And I want to make sure you use it for real, for real.

Oh yeah, and this post contains affiliate links to great products that will help you in your health journey. I will get a commission if you decide to buy from these links. Please let me know if you have any questions.

Free Christian Financial Budget Worksheets

Here Is Your FREE & Easy Mini Beautiful Budget Binder Planner Printable Template!

I won’t make you wait for it because I don’t like fluff any more than you do.

So first I will show the budgeting planner printable and share the link with you so you can download them in a snap!

Click here to download your FREE mini budgeting planner printables!

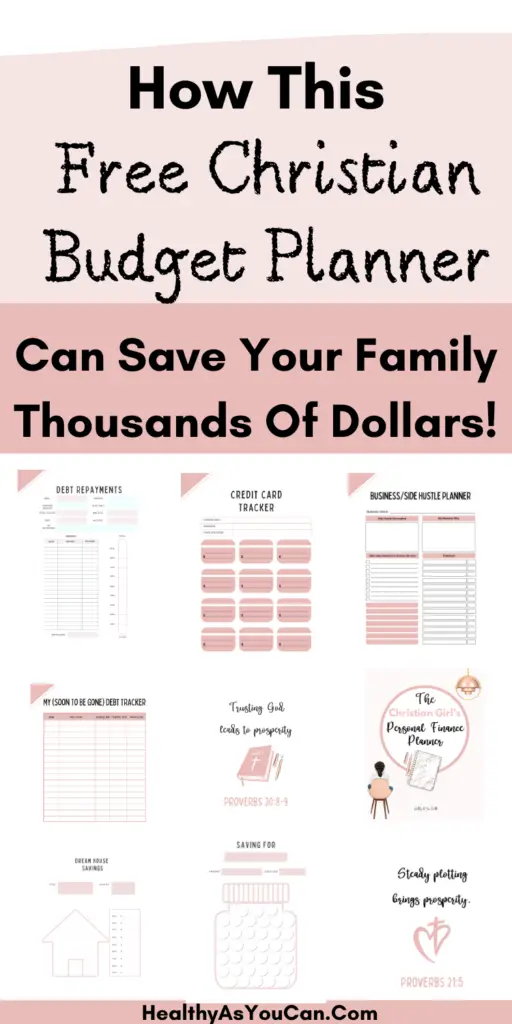

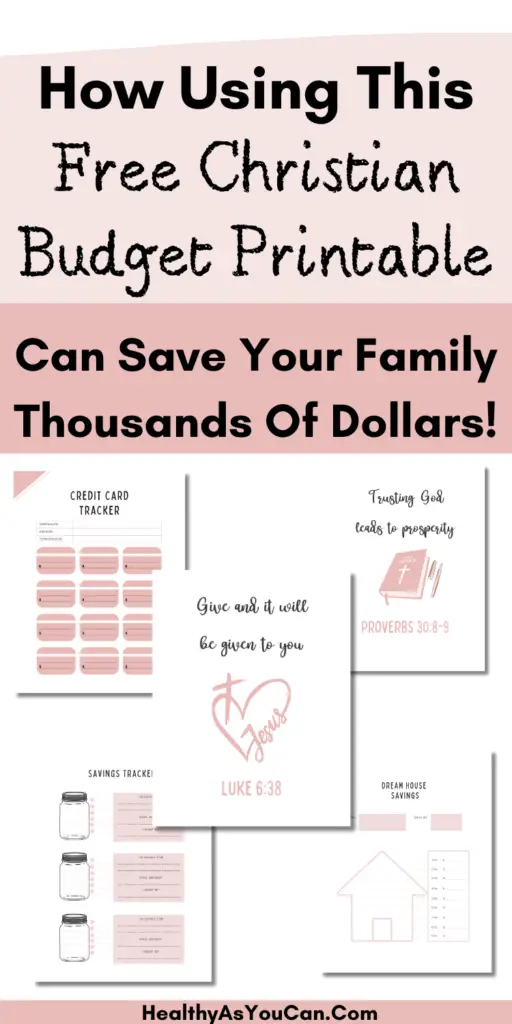

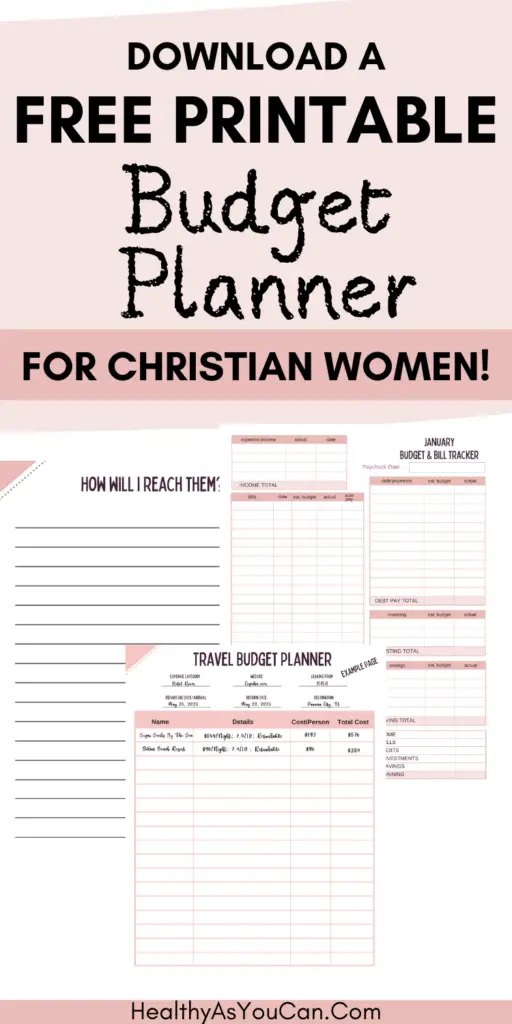

Need More Pages? Check Out The Full-Size Christian Budget Planner!

Now the free mini budget planner pages are a wonderful way to kickstart your budgeting journey.

But if you want a full-sized planner that has budget planning pages for every month of the year, then you will want to get your copy of the Christian Girl’s Budget Planner and Journal which you can get by clicking here!

It’s only 5.99 and this small investment can have a huge impact on your future!

This is what the Christian Girl’s Personal Finance Planner has:

– Yearly Goals

– Prayer Journal Pages

– Goal Planning Pages

– Monthly Expense Tracker

– Debt Trackers

– Savings Trackers (save for a house, car, or anything you want)

– Monthly Budget & Bill Tracker

– Inspiration Scripture Art Pages

– Monthly Debt Payoff Plan

– Monthly Lookback & Reflection Page

– Monthly At A Glance Pages

Get your copy of the Christian Girl’s Budget Planner and Journal which you can get by clicking here!

What Is A Budget?

Alright ma’am so now that we have our budget planner, we need to know how to use it, right? So ladies, let’s talk about what a budget is.

Even though a budget sounds restrictive, it is just a financial tool that empowers you to take control of your money.

Look at a budget like a roadmap for your finances, helping you stay on course as you become a better steward of what God has blessed you with.

I know I used to pray that the Lord would help me make more money and I was so frustrated when it didn’t seem like He was answering my prayer.

What I didn’t realize is that because I was doing such a BAD job (it is what it is) with the money He had already given me, God probably didn’t think it made sense to give me more money so I could squander that too.

What do I mean by squander? I mean I had no idea how much money I was spending. I was certain I wasn’t spending that much.

Oh y’alll… I was so wrong. It wasn’t until I created a budget that I was able to see where my money was going.

All I did was start using paper and a Word document to start tracking my spending, calculating my debt, and creating a plan to pay off my debt. That’s all a budget really is.

A written plan for your money so you can build wealth for you and your family. That’s not scary or restrictive. It sounds like freedom to me!

So, let’s embrace the financial freedom that budgeting brings and pave the way for a future filled with financial confidence and success!

Want to read this post later? Save it to one of your money Pinterest boards!

Why Use Budgeting Printables

Ladies, if the idea of creating a budget feels overwhelming, fear not—enter budget planner printables, your financial game-changer!

Picture them as your personal finance expert, designed to simplify the budgeting process.

A budget printable is essentially a pre-designed structure that outlines different spending categories, helping you organize your income and expenses effortlessly.

It’s great for those of you who freeze up looking at a blank spreadsheet or piece of paper.

These templates are like blueprints for financial success, taking the guesswork out of where your money should go. They cater to your specific needs, offering flexibility to adapt to your lifestyle.

Think of it as a stress-free guide to managing your finances, giving you the freedom to customize without starting from scratch.

How Do You Make a Printable Budget Sheet

Now if you’re the ambitious type you might want to make your own budgeting planner pages. If that’s the case, I recommend you use Canva. It’s easy to use and it’s free with some limited capabilities.

Start by logging into Canva and navigating to the “Create a design” section. Choose the “US Letter” template for a standard printable size.

Or to save time and search for “budget” on the home page and look for a cute template that you like and click the template to open it.

Next, personalize your budget sheet by adding categories that reflect your spending habits, such as bills, groceries, self-care, and savings.

Canva offers a variety of stylish fonts and colors, allowing you to infuse your unique flair into the design. Include income and expense sections, making sure to allocate amounts based on your current financial situation.

Using Canva’s drag-and-drop interface, you can easily add icons or images to make your budget visually appealing.

Once you’re happy with the way your budget planner looks, download your masterpiece as a PDF, ready to print.

What Should Be Included In A Budget Binder Planner

A well-organized budget binder can be a powerful tool for financial management.

Consider including the following sections to make it comprehensive (Side note: I have all of these sections in the Christian Girl Budget Planner)

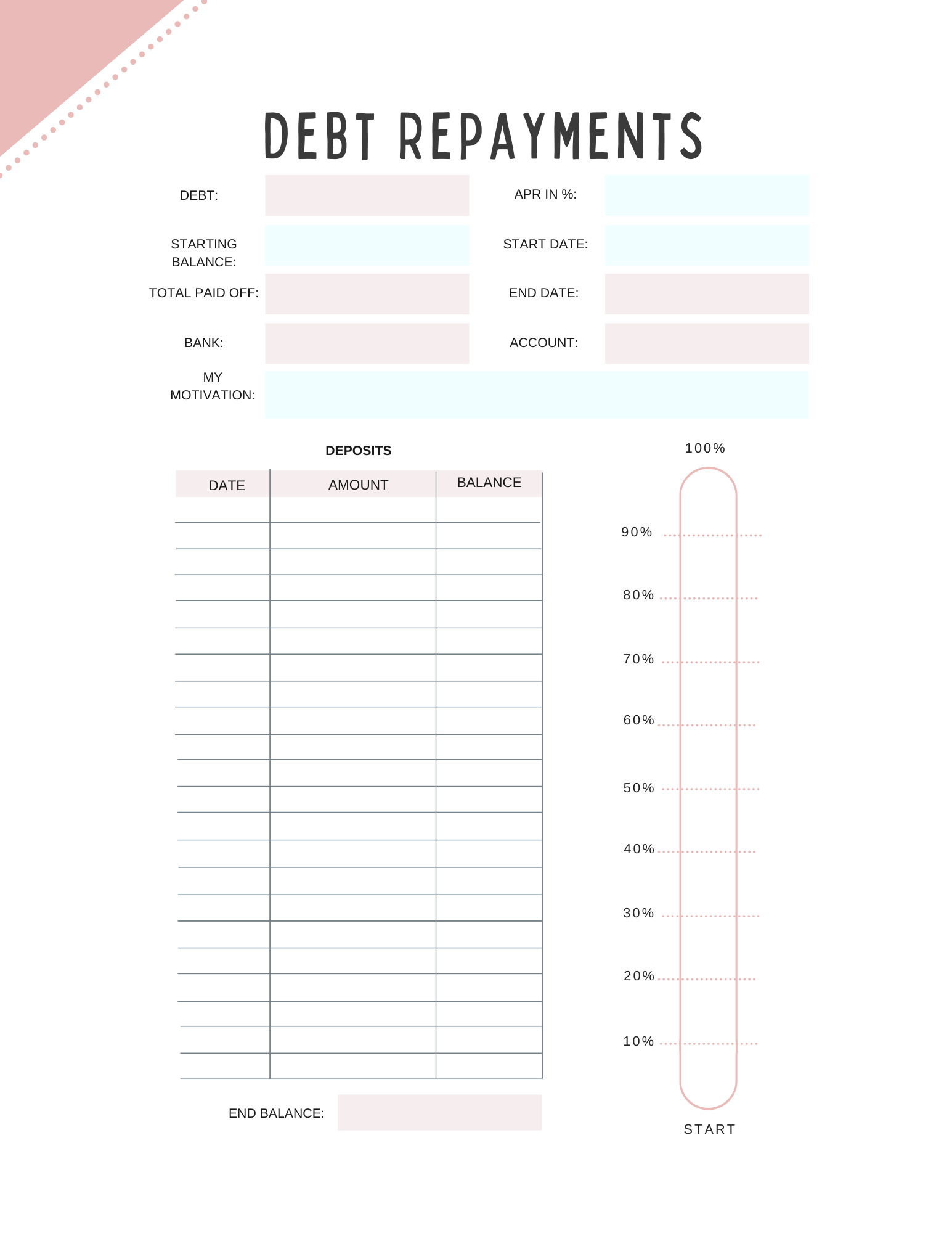

Track your debt-free journey-included in Christian Girl’s Budget Planner!

1. **Debt Tracker:**

– List of debts (credit cards, loans).

– Payment schedule and progress.

– Debt repayment plan.

Getting out of consumer debt is one of the first financial goals you should have in your journey to financial freedom.

So having a way to track your progress to becoming debt-free is a great way to motivate yourself to achieve that goal!

I include debt trackers in my free budget planner that you can download here

2. **Side Hustle/Business Income Planner**

- Side Hustles to start

- Goal tracker

If you are trying to get out of debt, one of the ways to speed up the process is by getting a side hustle or starting a business.

Using the income from your side hustle or business can help you accelerate your debt-free journey twice as fast!

3. **Income Tracker:**

– Pay stubs or income statements.

– Other income sources.

You can use this section to track your income from your main job and any side hustles or businesses you start

4. **Expenses:**

– Fixed expenses (rent/mortgage, utilities, insurance).

– Variable expenses (groceries, dining out, entertainment).

Be especially mindful of variable expenses. I used to think that I didn’t spend that much money until I started tracking my variable expenses.

Then I started to realize where all of my money was going…those trips to Dollar Tree started to add up, just saying!

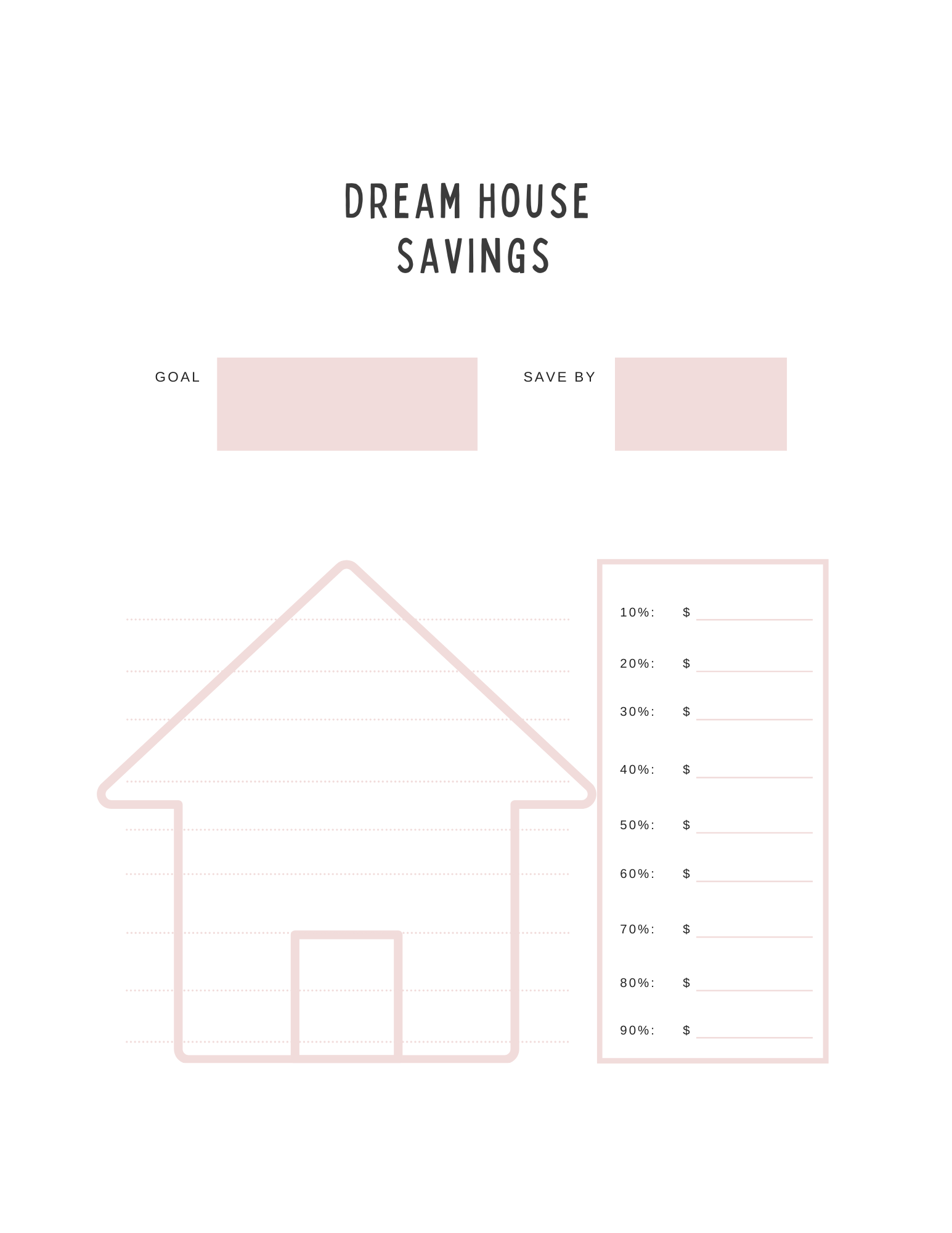

Save for your dream house with this savings tracker!

5. **Savings:**

– Emergency fund tracker.

– Savings goals and progress.

As you begin to pay off your debt, start putting that money into a high-yield savings account like Ally Bank and watch your money grow every month! Why a high-yield savings account?

Because you will be earning interest sometimes over 4% interest on your money every single month! It’s an easy way to make passive income and have a higher return then just saving alone.

This is especially important when saving for something as big as a house (see pic above) or a car!

6. **Financial Goals Journal:**

– Short-term and long-term goals.

– Action plans to achieve them.

Use this section to write down your short-term and long-term financial goals

7. **Monthly Budget Planner**

– List of debts (credit cards, loans).

– Payment schedule and progress.

– Expected Income for the month

– Expected savings for the month

This is the section where you will go to every month and calculate your bills for that month, how much you plan to save, how much debt you have left, and how much debt you plan to pay off.

I like having a page like this for every month of the year so I can see my annual progress.

8. **Debt Prayer Journal**

This is where you actually write down a prayer to the Lord about your debt and ask Him for help in improving your financial situation.

Ask Him what your next steps should be. Ask Him to help you make a plan to get out of debt.

You may feel overwhelmed with your current financial situation. Ask Him to take burden off of you and for help in being a better financial steward.

The Christian Girl’s Budget Planner has scripture pages to inspire your journey!

9. **Financial Inspiration:**

– Quotes, scriptures, affirmations, or vision board for motivation.

Having a budget binder with these components helps you stay organized, track your progress, and maintain a clear overview of your financial landscape. It becomes a valuable resource in achieving your financial goals and maintaining control over your money.

How Do You Use Budget Template Printables?

Using budget template printables can simplify the budgeting process. Here’s a step-by-step guide for incorporating them into your financial routine:

1. **Buy, Create, Or Download The Budget Planner You Like:**

– Choose a budget template that aligns with your needs and preferences. Many templates cover various aspects like income, expenses, savings, and debt.

2. **Personalize Categories:**

– Customize the template by adding specific spending categories relevant to your lifestyle. This ensures the budget reflects your unique financial situation.

3. **Set Budget Goals:**

– Establish clear financial goals for the month or year. Use the template to allocate funds to each category based on your income and priorities.

4. **Record Income and Expenses:**

– Regularly update the template with your actual income and expenses. This can be a daily, weekly, or monthly task, depending on your preference.

5. **Track Spending:**

– Use the template to track your spending in each category. This helps you stay within budget and identify areas where adjustments may be needed.

6. **Review Regularly:**

– Schedule regular reviews of your budget template to assess your financial progress. This allows you to make necessary adjustments and celebrate achievements.

7. **Monitor Savings and Debt:**

– If your template includes sections for savings and debt, use them to monitor progress toward your goals in these areas.

8. **Keep Records:**

– File completed templates or create a section in a budget binder to maintain a historical record of your financial activity. This can be valuable for future planning and analysis.

9. **Adjust as Needed:**

– Life is dynamic, and financial circumstances can change. Be ready to adjust your budget template to accommodate unexpected expenses or changes in income.

By consistently using a budget template printable, you create a structured approach to managing your finances, gaining better control, and working towards your financial goals.

Want to read this post later? Save it to one of your money Pinterest boards!

How Is A Christian Budget Different From A Regular Budget?

As Christians, our lives are centered around Jesus Christ and His will. So the way we manage our money should not be any different. We should pray regularly over our budgets and the way we spend our money.

Ask God if we are being good stewards of our financial blessings.

Study the Bible for principles on money, how to work hard, investing, saving money, and more!

If we were just creating a budget for ourselves or for our families, we would not need to consider God and what He wills for our money or our lives. We could just be concerned only with our own desires.

But because of Jesus’ sacrifice for us, we consider Him in all things including our budget.

And using things like a Christian budget planner and prayer journals, we make considering and consulting with the Lord so much easier!

So if you are ready to use a free Christian budget planner that you can print out in just a few seconds, go ahead and click this link and start your financial stewardship journey today!

Want to read this post later? Save it to one of your money Pinterest boards!

If Christian Personal Finance Budget Planner has helped you, please share it!

Want more money-related content? Check out these HAYC Posts:

9 Life-Altering Money Mistakes Financially Independent Women Don’t Make

2 Money-Saving Tips To Motivate You Towards Financial Freedom

9 Simple Steps to Financial Freedom ( Which Step Are You On?)

How To Stay Out Of Debt By Following These 3 Simple Tips

5 Secrets To Improving Your Credit Score So You Can Always Get Approved

7 Cringe-Worthy Habits That Keep Christians From Being Debt Free

3 Credit Card Debt Tips That Put You On The Road To Financial Freedom!

Financial Disclaimer: Healthy As You Can (blog posts & products) is not offering any kind of financial advice. Any financial results discussed on this blog are not typical or guaranteed. Healthy As You Can is not a registered financial, investment, legal, tax advisor, or broker. This blog is for information and entertainment use only. A financial fund’s past performance does not predict or forecast its future results.